Nonprofit Kansas Values Institute spent $23 million to help Gov. Laura Kelly and other candidates in 2022

KVI raised and spent more in 2022 than in the previous 11 years combined

Note: A separate article reveals known donors to Kansas Values Institute in 2022.

At the Dec. 2022 Kansas Post-Election Conference at the Dole Institute in Lawrence Director Emeritus Bill Lacy asked KVI’s executive director about the 2022 KVI budget. Evan Gates said “the numbers that are floating around out there are $17.5 million that KVI spent.”

How could that number be verified? The 2022 IRS 990 tax filing by nonprofit Kansas Values Institute would show revenues and expenditures, but when would KVI release that document?

Such filings are often made a year or more after an election. IRS processing delays since COVID have made finding some IRS 990s more difficult.

A Nov. 2023 WatchdogLab article showed KVI historically filed their 990s in mid-November, but a request to KVI resulted in this response:

We file on a delayed schedule. Our 2021 990 is the most recent 990. Feel free to circle back after the 2022 990 is publicly filed in the new year. Evan Gates, 11/16/2023

Gates replied to a Jan. 24 request, and after a payment of $8, she provided a copy of their 990 in late February.

The 990 gave information about the $23 million KVI raised and spent in 2022, which was over 30% higher than the $17.5 million estimate given at the Dole Institute meeting.

The two largest donors gave $12.8 million and $3.65 million. Eight-six other contributors donated $6.2 million.

In twelve years from 2011 - 2022 KVI raised and spent nearly $40 million to shape the Kansas political landscape.

IRS 990 for 2022

Download the 40-page Kansas Values Institute’s 2022 IRS 990 PDF:

This copy was not dated, but the KVI IRS 990 XML file downloaded from the IRS or ProPublica shows a filing timestamp of Nov. 15, 2023. To comply with IRS rules Gates should have released their 990 “within 30 days in the case of written requests.”

Summary of Revenue and Expenses

Major Expenditures

KVI identified two major accomplishments that cost $23 million:

KVI spent nearly $22.8 million on their “issue advocacy and public education projects.”

KVI’s “issue advocacy and public education projects” were most visible to the public in their print and broadcast ads.

Kansas Values Institute created 20 TV ads to “educate” the public, which were captured by Washburn University’s “Kansas Political Ads” and labeled “pro-Kelly, anti-Schmidt.”

The 20 TV ads can still be viewed online at the Kansas Institute for Politics:

Kansas Values Institute PAC (pro-Kelly, anti-Schmidt)

Radio Ad

1 |

TV Ads

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 |

The huge task of studying all records available in FCC Public Inspection Files for Kansas TV stations related to these ads has not been attempted.

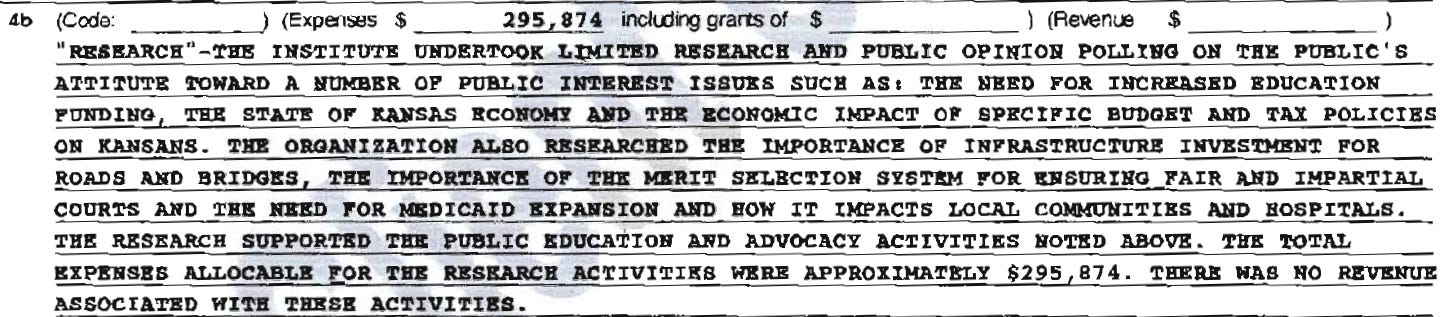

A lesser expenditure of almost $300,000 was for research and public opinion polling:

Donors

As part of their IRS 990 filing, nonprofits receiving $5000 or more in contributions must complete a list of the number of contributors and individual amounts. But no disclosure of names of contributors is required.

The 990 shows KVI had 88 contributors of $5000 or more with the largest single contributor giving $12,826,000!

Some of these donors can be be identified through other required reports, but donors can only be identified for about 27.5% of the money raised in 2022:

Nonprofit donors through their IRS 990 filings: $3,625,000

Federal PAC donors through FEC filings: $1,625,000

IRS 527 PAC filings: $805,000

Kansas PAC filings: $185,000

Individuals giving directly to a nonprofit are not revealed in an IRS 990 filing and are only known if these individuals self-identify.

A report from 2022 showed KVI donors could only be identified for about 30% of the money raised from 2011 - 2021.